In the ever-evolving landscape of real estate, market conditions play a pivotal role in shaping buying decisions. Two primary market scenarios stand out: a buyer's market with higher interest rates and lower prices, and a seller's market with limited inventory and extreme demand driven by lower interest rates. Each offers unique advantages and considerations for prospective buyers. In this blog post, we will delve into the benefits of purchasing real estate in a buyer's market with higher interest rates and lower prices, comparing it to the challenges posed by a seller's market with less inventory.

The Buyer's Market with Higher Interest Rates, Lower Prices, and less competition:

-

Enhanced Affordability: In a buyer's market, where prices are lower due to decreased demand, properties become more affordable. This, coupled with higher interest rates, might seem counterintuitive. However, when interest rates are higher, sellers might be inclined to lower their asking prices to attract buyers. This can create a window of opportunity for savvy buyers who can secure a home at a reduced cost.

-

Favorable Negotiation: With a surplus of properties and fewer potential buyers, negotiation power shifts toward the buyer. Sellers are often more open to negotiations, considering the need to move their property quickly. Buyers can leverage this advantage to secure better terms, concessions, and possibly even favorable upgrades or repairs.

-

Ample Inventory and Options: In a buyer's market, the array of available properties increases, offering buyers a broader range of options. This allows them to be more discerning in their choices, selecting a property that aligns with their preferences and requirements.

-

Less Competition: The reduced competition in a buyer's market allows potential buyers to take their time in making decisions. There's less urgency to make an offer quickly, giving buyers the opportunity for thorough due diligence.

-

Investment Opportunities: Investors are drawn to buyer's markets as they can capitalize on lower property prices and potentially higher rental income. This is especially beneficial when interest rates are higher, as it can offset the slightly increased borrowing costs.

The Seller's Market with Less Inventory, higher prices, and tons of competition:

-

Increased Property Value: In a seller's market, limited supply and high demand can drive property prices upward. This increase in demand also results in tough competition and oftentimes results in Sellers only considering cash offers without a finance contingency. A lower interest rate for potential buyers could be a moot point when Sellers won't consider a financing buyer offer.

-

Quick Sale Potential: Properties tend to sell faster in a seller's market due to the scarcity of options. This quick turnover often results in a sense of urgency for buyers who missed out and subsequent listings starting at an unsubstantiated asking price.

-

Minimal Price Negotiation: With multiple buyers vying for limited inventory, the negotiating power shifts toward sellers. Buyers might have less room for price negotiation, and sellers can expect offers closer to or above their asking prices.

-

Competition and Bidding Wars: In a competitive seller's market, buyers might find themselves engaged in bidding wars for highly sought-after properties. This competition results in Buyers having to make offers as-is, oftentimes waiving inspections, and offering creative incentives to have their offer considered.

-

Less Time for Decision-Making: In a seller's market, the urgency to secure a property often means buyers must make quick decisions. This limited time for due diligence can lead to making hasty choices without thorough research.

Making an Informed Decision:

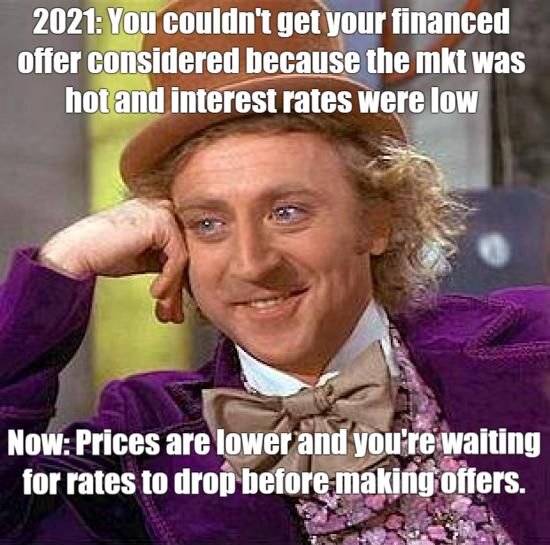

Ultimately, the decision to buy real estate in a market with higher interest rates and lower prices versus a market with limited inventory and lower interest rates depends on individual circumstances and long-term goals. While there may be a reluctance to purchase in a market with higher interest rates there is a strong likelihood of purchasing a property below the asking price. Alternatively, waiting for interest rates to drop could be counterproductive. As rates fall the demand by buyers will increase, shifting to a seller's market and undoubtedly higher asking prices and the possibility of competing against cash offers. Regardless of the market conditions, a strategic approach, expert advice, and thorough research are essential to making an informed decision that aligns with personal and financial objectives.

Planning on buying or selling a home in Southwest Florida? Our experienced agents at KEY Real Estate can help you with all of the questions related to the current market conditions. Contact us here or call 239-312-3120 to connect with one of our Southwest Florida real estate experts today!

Posted by Kevin E Yankow on

Leave A Comment